Need Help? Call

(801) 427-0866

Retirement Planning

Start Planning For The Future Now

Retirement planning used to be simpler: your parents and grandparents typically worked for the same employer for their entire careers, then upon retiring were paid a pension. This pension continued to provide an annual income for them — regardless of how long they lived.

These days, pensions have all but vanished, as the burden of retirement planning has moved from the employer to the employees.

Now that they’re responsible for their own retirements, many workers are seeking ways to recreate the yearly stream of income that traditional pensions provided — without the fear of running out of money in retirement. For those workers, annuities are an appealing option as they provide a lifetime guaranteed income stream.

We Are Here To Help!

Reach out to us today to find the coverage you need!

What Are Annuities?

Annuities are an investment tool that generally offers safety from loss. They also allow you to grow money, which you’ll “annuitize” at retirement.

By definition, annuitize is the process of converting an investment into a series of periodic income payments. Basically, you’ll turn what you’ve accumulated into a lifelong income stream that’s guaranteed to last as long as you do!

Types of Annuities

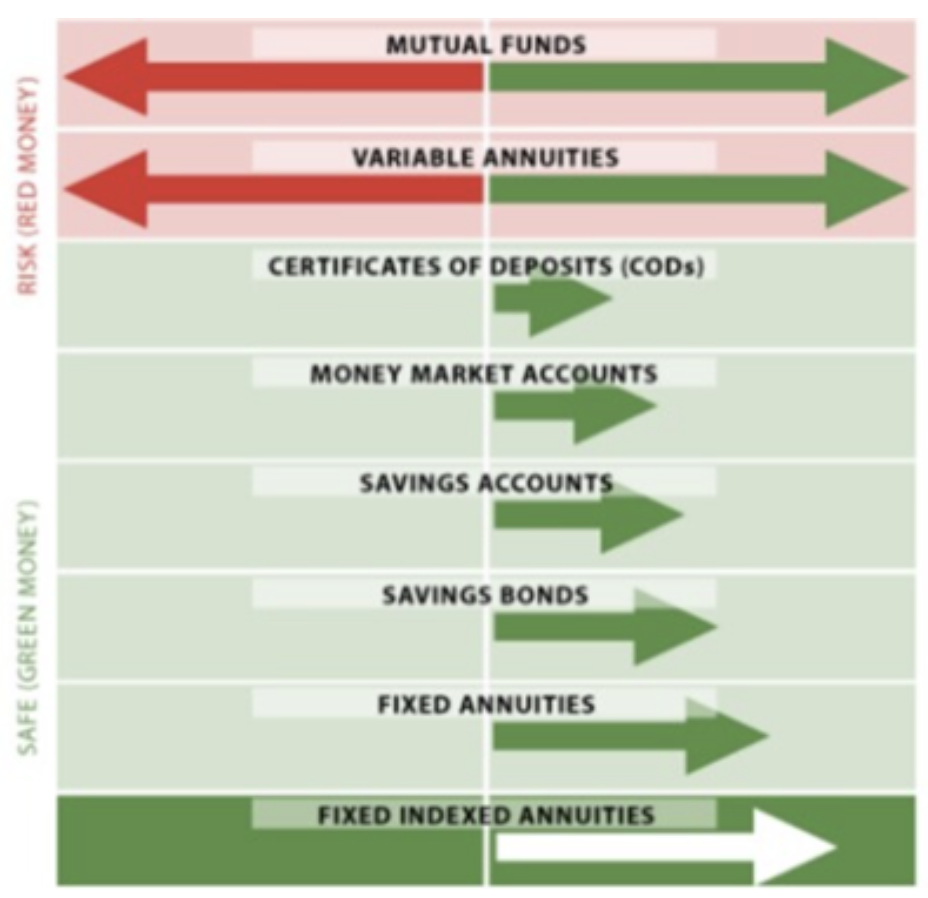

There are two types of annuities: variable and fixed.

Variable

In variable annuities, your principal is invested in the market. It can grow or shrink depending on what the market does. This is a riskier type of annuity — you can lose principal if the market drops. But if performance is good, you have the potential for higher upside.

Fixed

In a fixed annuity, your interest rate is set (annually) and won’t change, despite what the market does. This is the most conservative type of annuity with the most predictable results. In other words, you’re guaranteed to never lose any principal. However, growth will be somewhat modest.

Fixed Indexed Annuity

There’s a special type of fixed annuity which offers the best of both worlds: the security of a traditional fixed annuity and the potential upside of a variable annuity. A fixed indexed annuity, or FIA, will credit interest based on the performance of a market, like a variable annuity, but will establish what’s known as a ceiling and a floor to minimize risk.

Think of an indexed annuity as building your retirement skyscraper. When conditions are good, upward progress is made. There’s no limit to how high you can build — only how much you can build in any given period. When conditions are bad, your construction may pause, but you won’t lose any progress either. And when conditions improve, construction begins again.

The Bottom Line

Outliving your money in retirement is a real risk. And consider this: the average couple retiring at 65 can expect to pay $260,000 in health care costs in retirement. You need funds that accumulate (tax-deferred) over time, and we have solutions.

The most significant thing isn’t how big of a money pile you can create before retirement. It’s the assurance of knowing that you’ll never outlive that pile. That peace of mind is what separates annuities from other retirement vehicles.

Annuity Checklist

Most insurance companies are required to verify the annuity you choose is suitable for your:

- Age

- Financial Situation

- Retirement Goals

Work With A Trusted Professional

With that in mind, not all annuities are created equal. It’s important to work with a financial advisor you trust.

Contact a professional at FinServe Financial with Black Swan Insurance Group to see if an annuity makes sense for you and your retirement plan.

© 2023 All Rights Reserved. Site design by Black Swan Marketing LLC, FinServe Financial. Terms Of Service | Privacy Policy